Dr E. Kalotychou

Assistant Professor of Finance - Department of Commerce, Shipping and Finance,

Cyprus University of Technology

Can gender-diverse boards play a role in preventing costly bank misconduct episodes?

In recent years, larger numbers of scandals and fraud episodes have led to the world's largest banks being hit with an unprecedented number of misconduct fines, amounting to over £330 billion between 2012 and 2018. The incidents reflect the harm suffered by those who deal with the banks and represent a financial and reputational threat to individual financial institutions as well as the broader financial sector.

Preventing bank misconduct is a top priority for international regulators and policymakers and several rules aiming to offer solutions through better regulation or enforcement were recently enacted. There are several challenges that lawmakers and regulators face in this context, however: regulatory reforms might not be effective without changes in bank corporate culture. To address a potentially toxic culture in financial services, regulators have emphasised increased diversity. The underlying idea is that the tone at the top shapes a firm’s conduct and ethical culture and that more diverse boards, with an increased presence of women, would positively affect company governance. In recent years there have been several high-profile campaigns aiming to increase female representation on company boards. Countries such as France, Italy, and Sweden have gone a step further, introducing mandatory gender quotas. While some progress has been achieved, there is still a long way to attaining gender balance in corporate governance.

We consider the fines issued by US regulatory bodies on European listed banks in the post-crisis period (2007-2018), which relate to misconduct events such as tax evasion, money laundering, market manipulation, and fraud. Our findings suggest that greater female representation significantly reduces the frequency of misconduct fines. The mechanism through which gender diversity affects board effectiveness in preventing misconduct stems from the ethicality and risk aversion of the female directors, rather than their contribution to diversity and to a broader set of skills.

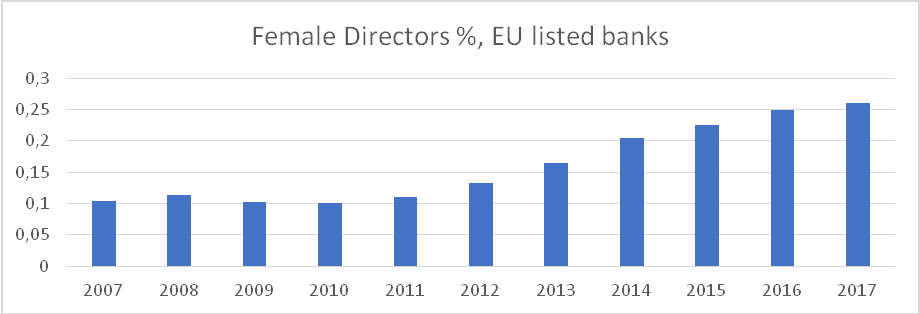

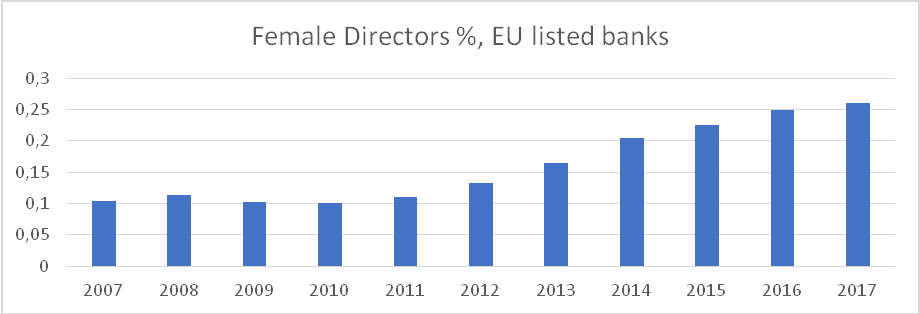

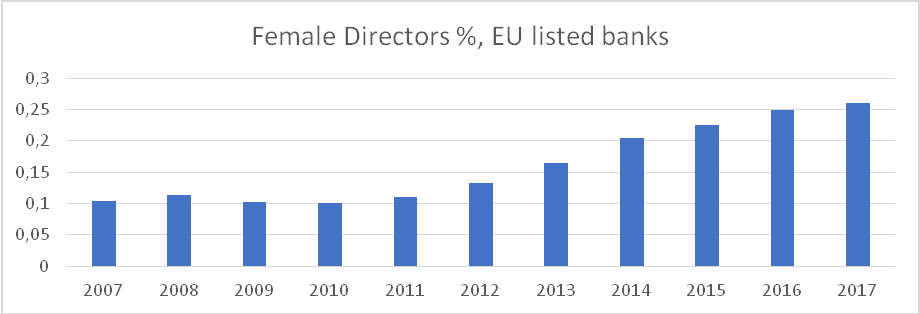

Based on board-related information for all listed European banks, we find that female representation gradually increased from an average of 10.4% in 2007 to 26.1% in 2017. The presence of female leaders also shows an upward trend during the sample period: female CEOs increased from only 1.5% in 2007 to 7.9% in 2017. Nevertheless, banks’ boardrooms remain male-dominated.

Figure 1: Female representation in EU listed bank boards

Establishing a causal relationship between board diversity and bank misconduct is challenging. Because of political connections, lobbying activities, or concerns about the financial stability of the domestic banking system, regulatory agencies might be vulnerable to regulatory capture bias, making them less impartial and objective in imposing sanctions on domestic banks. We exploit the fact that US regulators can impose fines not only on banks operating in the US, but on all transactions that pass through its financial system to US and non-US persons, entities, and institutions. US regulators hit foreign financial institutions particularly hard following the crisis: European banks have been fined four times more than their US counterparts, representing 77% of the total fines levied by US regulators since 2008.

In our analysis, we find that a larger presence of women on the boards of directors is associated with fewer misconduct fines. The effect is economically significant: representing an annual saving of $7.48 million. These results seem to support the view that increased gender diversity helps foster a better corporate culture, thus reducing conduct risk. Our analysis also highlights that women have a more significant role in curbing misconduct when the number of female directors reaches a critical mass (at least three women) and are supported by women in leadership roles.

In conclusion, our results support the view that gender has a significant effect on the attitudes of managers towards business ethics but also risk-taking: gender diversity improves bank culture and reduces conduct risk. We also find that women are more influential in countries with higher gender equality. While most European countries have made considerable progress in terms of gender equality in areas such as educational attainments and healthy; substantial inequality remains in areas such as economic participation and political empowerment. One of the biggest challenges lies in changing stereotypes and bias in society, highlighting the importance of government and regulatory initiatives aimed at fostering gender diversity.

Πρόσκληση σε Διαδικτυακό συνέδριο του προγράμματος Media Lab

Dr E. Kalotychou

Assistant Professor of Finance - Department of Commerce, Shipping and Finance,

Cyprus University of Technology

Can gender-diverse boards play a role in preventing costly bank misconduct episodes?

In recent years, larger numbers of scandals and fraud episodes have led to the world's largest banks being hit with an unprecedented number of misconduct fines, amounting to over £330 billion between 2012 and 2018. The incidents reflect the harm suffered by those who deal with the banks and represent a financial and reputational threat to individual financial institutions as well as the broader financial sector.

Preventing bank misconduct is a top priority for international regulators and policymakers and several rules aiming to offer solutions through better regulation or enforcement were recently enacted. There are several challenges that lawmakers and regulators face in this context, however: regulatory reforms might not be effective without changes in bank corporate culture. To address a potentially toxic culture in financial services, regulators have emphasised increased diversity. The underlying idea is that the tone at the top shapes a firm’s conduct and ethical culture and that more diverse boards, with an increased presence of women, would positively affect company governance. In recent years there have been several high-profile campaigns aiming to increase female representation on company boards. Countries such as France, Italy, and Sweden have gone a step further, introducing mandatory gender quotas. While some progress has been achieved, there is still a long way to attaining gender balance in corporate governance.

We consider the fines issued by US regulatory bodies on European listed banks in the post-crisis period (2007-2018), which relate to misconduct events such as tax evasion, money laundering, market manipulation, and fraud. Our findings suggest that greater female representation significantly reduces the frequency of misconduct fines. The mechanism through which gender diversity affects board effectiveness in preventing misconduct stems from the ethicality and risk aversion of the female directors, rather than their contribution to diversity and to a broader set of skills.

Based on board-related information for all listed European banks, we find that female representation gradually increased from an average of 10.4% in 2007 to 26.1% in 2017. The presence of female leaders also shows an upward trend during the sample period: female CEOs increased from only 1.5% in 2007 to 7.9% in 2017. Nevertheless, banks’ boardrooms remain male-dominated.

Figure 1: Female representation in EU listed bank boards

Establishing a causal relationship between board diversity and bank misconduct is challenging. Because of political connections, lobbying activities, or concerns about the financial stability of the domestic banking system, regulatory agencies might be vulnerable to regulatory capture bias, making them less impartial and objective in imposing sanctions on domestic banks. We exploit the fact that US regulators can impose fines not only on banks operating in the US, but on all transactions that pass through its financial system to US and non-US persons, entities, and institutions. US regulators hit foreign financial institutions particularly hard following the crisis: European banks have been fined four times more than their US counterparts, representing 77% of the total fines levied by US regulators since 2008.

In our analysis, we find that a larger presence of women on the boards of directors is associated with fewer misconduct fines. The effect is economically significant: representing an annual saving of $7.48 million. These results seem to support the view that increased gender diversity helps foster a better corporate culture, thus reducing conduct risk. Our analysis also highlights that women have a more significant role in curbing misconduct when the number of female directors reaches a critical mass (at least three women) and are supported by women in leadership roles.

In conclusion, our results support the view that gender has a significant effect on the attitudes of managers towards business ethics but also risk-taking: gender diversity improves bank culture and reduces conduct risk. We also find that women are more influential in countries with higher gender equality. While most European countries have made considerable progress in terms of gender equality in areas such as educational attainments and healthy; substantial inequality remains in areas such as economic participation and political empowerment. One of the biggest challenges lies in changing stereotypes and bias in society, highlighting the importance of government and regulatory initiatives aimed at fostering gender diversity.